- Riding the Yield Curve – In a normal upward sloping yield curve, yield of a security rises as its maturity increases. Using this strategy, if a fund manager holds on to a bond of a higher maturity over a period of time, it’s yield would tend to fall as it comes down the yield curve (drops in maturity). Owing to the inverse relationship between yields and prices, the price of the bond would rise and help to earn returns via capital gains using this strategy.

- Riding the Spread Curve – Typically bonds with a higher credit risk command a higher yield as risk and yields are commensurate. Using this logic, corporate bonds command higher yields vis-a-vis government bonds of the same maturity. This difference in yields is called yield spreads or credit spreads. These spreads widen as the economy weakens and corporate bonds offer higher yields. In such a situation, investing in well researched corporate bonds may provide higher accrual yields. This is called riding the spread curve.

- Spread Compression – The opposite of the above happens when the economy improves and spreads (yields) decrease or compress. Owing to the inverse relation between yields and prices, the prices of these bonds rise and one stands to gain from capital appreciation via Spread Compression strategy.

- Rating Upgrade – Bond prices and credit ratings are directly co-related. Higher the rating, higher the price for same maturity bonds. This strategy revolves around buying a well-managed company’s bonds with a relatively lower credit rating. As the economy improves, the sales and profitability of this company also improves. This may lead to its rating being upgraded. One, who can gauge that a company’s fundamentals are going to change for the better, can lock into a higher yield first and also benefit from the price rise when the rating goes up. However, it needs a lot of research to identify such companies.

Inflation Rate | 9% | ||||||

11%GS2029 | |||||||

Base Year for Calculation is 2014 | |||||||

Face Value 100 | |||||||

Year | No. Of Years | Coupon | DCF | WDCF | |||

2014 | 1 | 11 | 10.09174 | 10.09174 | |||

2015 | 2 | 11 | 9.25848 | 18.51696 | |||

2016 | 3 | 11 | 8.494018 | 25.48205 | |||

2017 | 4 | 11 | 7.792677 | 31.17071 | |||

2018 | 5 | 11 | 7.149245 | 35.74623 | |||

2019 | 6 | 11 | 6.558941 | 39.35364 | |||

2020 | 7 | 11 | 6.017377 | 42.12164 | |||

2021 | 8 | 11 | 5.520529 | 44.16423 | |||

2022 | 9 | 11 | 5.064706 | 45.58235 | |||

2023 | 10 | 11 | 4.646519 | 46.46519 | |||

2024 | 11 | 11 | 4.262861 | 46.89147 | |||

2025 | 12 | 11 | 3.910882 | 46.93058 | |||

2026 | 13 | 11 | 3.587965 | 46.64355 | |||

2027 | 14 | 11 | 3.291711 | 46.08396 | |||

2028 | 15 | 11 | 3.019918 | 45.29878 | |||

2029 | 16 | 111 | 27.95754 | 447.3207 | |||

116.6251 | 1017.864 | ||||||

Duration | 8.73 | Years |

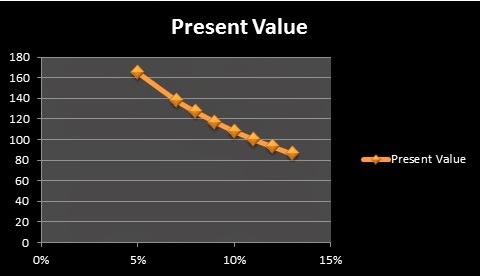

INF Rate | Present Value |

5% | 165 |

7% | 138 |

8% | 127 |

9% | 117 |

10% | 108 |

11% | 100 |

12% | 93 |

13% | 86 |

For example, a change in short-term interest rates that does not affect long-term interest

rates will have little effect on a long-term bond’s price and yield. However, a change (or no change when the market perceives that one is needed) in short-term interest rates that affects long-term interest rates can greatly affect a long-term bond’s price and yield. Put simply, changes in short-term interest rates have more of an effect on short-term bonds than long-term bonds, and changes in long-term interest rates have an effect on long-term bonds, but not short-term bonds.

The key to understanding how a change in interest rates will affect a certain bond’s price and yield is to recognize where on the yield curve that bond lies (the short end or the long end) and to understand the dynamics between short- and long-term interest rates. With this knowledge, you can use different measures of duration and convexity to become a seasoned bond market investor. However in these segments, we have not discussed about Zero Coupon Bonds, or Sharia Bonds. Those are used for Religious beliefs and effective Tax tools for many countries across the globe, including India. In India these have to be certified by TASIS – BSE. Post which the discussion will be continued on Yield Curve (in depth), and riding of Yield Curve techniques using Convexity tools (in depth).