Sudindra V R

ABC Ltd Company operates in manufacturing of CFL bulbs, which established in the year 2008. Company Memorandum of Association, mentioned the Authorised/Registered/Nominal capital of company consists of 2,00,00,000 equity shares of Rs. 10 each. The total capital of the company consist of Rs. 50 Crores in 3 parts:

(1) 2,00,00,000 Equity shares of Rs. 10 each.

(2) 1,00,000 12% Preference shares of Rs. 1000 each and

(3) 2,00,000 15% Debentures of Rs. 1000 each.

The company provided information related to equity shares as under: Out of 2 Crore shares company issued 1.5 Crores equity shares to public for subscription (assuming the shares issued at par) with Application money of Rs. 2, Allotment Money of Rs. 3 and call money of Rs. 5.

The issue of shares to the public as under:

(1) Retail investors: 70 Lakh shares

(2) Non Institutional Investors: 40 Lakh shares

(3) Institutional Investors: 40 Lakh shares

The shares issued by company, oversubscribed by the public and the company issued shares at discretionary basis.

The entire equity shareholder paid full money on the shares issued to them, except on 1,00,000 shareholder who paid Rs. 5 (Application and Allotment money paid).

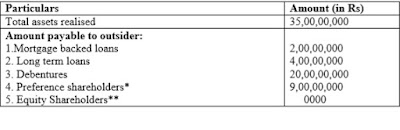

During the year 2015, ABC Company earned PBIT of Rs. 6 Crores (Assume applicable tax rate is 50%). Also due to dramatic changes in market, conditions and introduction of LED, ABC Company could not able to sustain in the market. Company went into liquidation during 2017 and realised the assets worth of Rs. 35 crores. At the time of liquidation company did not had any reserves/surplus. The following were the payable amount by the company.

(1) Mortgage backed loan Rs. 2 Crore.

(2) Long term liabilities Rs. 4 Crore

(3) Debentures Rs. 20 Crores

(4) Preference shareholders Rs. 10 Crore.

One of the equity shareholder approached you with the following questions and solicited your input. 1. How equity shares reflects in company books of accounts?

2. How debentures reflects in company books of accounts?

3. How equity shares differs from preference shares and debentures?

Suggested key: 1. Equity shares reflects in Liabilities side of balance sheet. Normally the detailed equity shares in the above case looks like:

2. Debenture reflects in the liabilities side of balance sheet, under the heading Long-term liabilities.

2,00,000 15% debenture of Rs. 1000 each Rs. 20,00,00,000

3. 3.1 Equity shareholders are real owners of the company, whereas preference Shareholders and debenture holders are not real owner of the company.

3.2 Equity shareholders are having right to vote and participate in management decision , whereas debenture holders not having any voting right and preference shareholders in some exception case exercise vote in decision making.

3.3 Returns on debenture holders and preference shareholders are fixed in nature; (In this case Debenture holders are getting interest amount of Rs. 3 Crores, ie. 15% of Rs. 1000 – Rs. 150 * 2,00,000 (no of debentures))

(In this case Preference, shareholders are getting dividend amount of Rs. 1.2 Crores, i.e. 12% of Rs. 1000 – Rs. 120 * 1,00,000 (no of preference shares))

It is discretion of management to give dividend to equity shareholders. Equity shareholders will be paid from the residual amount after paying debenture holders and preference shareholders.

In this case:

The available profit for equity shareholders is Rs. 30,00,000 can be distributed as dividend amount of Rs. 0.15 / 15 paisa per share to shareholders or create reserve for future contingencies instead of dividend payout.

3.4 Normally equity shareholders are liability is limited to the extent of capital and some cases unpaid capital. Whereas liability on debenture gives 1st preferences followed by preference shareholders.

In this case:

* Since amount available after paying debenture holders is Rs. 9 crores , preference shareholders are only entitled to the balance amount of Rs.9 Crores. ** Since amount available after paying preference shareholders there is no balance left and not entitle to receive amount. Also the 1,00,000 shareholders who have not paid amount of Rs. 5 each will have to pay Rs. 5,00,000. No further amount required to be brought by equity shareholders since

the company is limited liability entity.

the company is limited liability entity.

Note: the above case was developed based on imaginary company and imaginary figures and for the study purpose only, no references or citation available.