Vikku Agrawal (Faculty- finance)

Introduction:

The article examines the increasing popularity of crowdfunding in India and the challenges as a strong source of raising funds for financing an objective, whether social or commercial. With the country having the largest base of Facebook users and the second largest base of internet users, there is tremendous scope of procuring business finance through this source especially for small and medium enterprises which otherwise struggle to raise funds through traditional platforms (financial institutions).

Crowdfunding, primarily, is a call made openly to the investors or donors, essentially through the internet, for providing financial resources as mere donation or against a consideration, whether reward or financial return, to assist certain specific initiatives (Lambert and Schwienbacher, 2010).Additionally, crowdfunding is also termed as the endeavour by entrepreneurs -social, cultural or for- profit- to finance their ventures through small contributions from a fairly large base , using the internet and without using traditional platforms of finance ( Mollick,2014).

Arguably, though the idea has been around for centuries, it emerged as an organised way of capital formation during the wake of 2008 financial crisis in the US when banks became reluctant to lend to entrepreneurs and other greenhorns with an objective (Crowdfunding’s Potential for the Developing World. 2013. infoDev, Finance and Private Sector Development Department. Washington, DC: World Bank). In almost a decade, it has spread across the developed world including countries like Australia, the Netherlands, the United Kingdoms and the United States. The US Government, under the leadership of Barack Obama, formalised it in 2012 by passing the JOBS Act. Developing nations started gaining traction on this concept gradually and have been seeing great responses.

Owing to its low cost of raising funds, crowdfunding is getting increasingly popular. The main reasons why investors connect with crowdfunding are:

1. They connect with the objective of the campaign.

2. They are lured by the returns they see for themselves.

3. They like the creative display of the campaign.

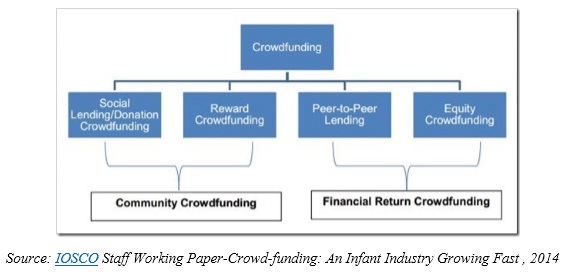

The IOSCO Staff Working Paper – Crowd-funding: An Infant Industry Growing Fast, 2014 identifies four different models of crowdfunding: Donor based, reward based, equity based and lending based (Peer to Peer).

Scope of Crowdfunding in India:

India has been exhibiting phenomenal growth in internet usage to position itself at the second place worldwide after China in terms of number of internet users.

As regards India’s passion for social media, it had a user base of about 216.5 million which is estimated to jump notably to around 358.2 million in 2021. The latter translates to 25% of the Indian population accessing social networks in 2021 from around 16.3 percent in 2016. India having the largest base of Facebook users worldwide, there were about 195 million Facebook users in India as of 2016. Other popular networks include WhatsApp, Google+, and Skype (https://www.statista.com/statistics/255135/internet-penetration-in-india/). Ironically, the transaction value in the crowdfunding segment amounts to US$1.7mn in 2019 in India out of the worldwide transaction value of US$6,923.6mn, about 0.025% of the global share .(https://www.statista.com/ ) This data endorses the potentiality of Crowdfunding in India in the forthcoming years.

Currently the country’s market is at its nascent stage of this idea. After Europe and North America, Asia features on the third place of the number of Crowdfunding platforms as per the 2014 data.

(https://www.statista.com/statistics/497227/number-of-crowdfunding-platforms-globally-by-region/) and India has approximately 20 crowdfunding platforms functioning: Milaap, Wishberry, Catapoolt, Ketto, Impact Guru, to name a few.

Are SEBI regulations on equity crowdfunding malleable?

Donor based, reward based and peer to peer based funding is outside the regulatory purview of SEBI since they do not generally involve issuance of securities for financial returns while it regulates equity crowdfunding. Peer-to-peer lending in India is regulated by the Reserve bank of India (RBI) under the Non-Banking Financial Company – Peer to Peer (Lending Platform (Reserve Bank) Directions, 2017 (Master Direction DNBR (PD) 090/ 03.10.124/2017-1 8 , RBI/DNBR/2017-1 8/57 ). Peer-to-Peer lending platforms are treated as NBFCs and need to be registered under the Companies Act 2013.

Globally, for equity based crowdfunding, there is a growing body of literature on associated risks- cybersecurity, fraud, money laundering, information asymmetry, political risks, financial literacy and awareness, expected changes in the regulatory framework etc. In light of these risks, while SEBI has made equity crowdfunding, the regulator has been working on framing concrete regulations relating to it on one hand and simultaneously reducing the cost of capital and increasing liquidity of money. It’s time that SEBI laterally formalised equity crowdfunding in India in the interest of the country’s radical economic transformation.

Behavioural aspects of investors

From global perspective, the success of Crowdfunding also rests on influencing the behaviour of the investor, in addition to its material benefits.

- The two social traits- attitudes toward helping others and interpersonal connectivity indirectly affect the investor’s intention to participate through social identification with the crowdfunding community.

- The personal trait- the individual’s level of innovativeness motivates an investor to be a crowd funder. (Ordanini et al., 2011, https://doi.org/10.1108/SJME-03-2018-004).

- On the flip side, herd mentality / bandwagon effect sometimes influences investors to an investment in two ticks. (“Crowdfunding from an Investor Perspective” by Financial Services User Group set up by European Commission)

Conclusion

Despite all odds, fast digitalising global economies and technological advancement are calling out to foster innovation for economic growth improving making the prospects of crowdfunding. The challenge lies in regulating the crowdfunding platforms to prevent undue pressure on the investor to invest and to save the misuse of the funds raised. As per the Consultation paper by SEBI in 2014, regulations like the minimum net worth of the accredited investors, both retail and institutional and conditions like the limit on the turnover of the enterprises seeking finance, their total capital and their business activity etc. have dampened the proliferation of equity crowdfunding in the country’s genuine interest. Sound social and environmental standards and fixing accountabilities within the business operations of crowdfunding platforms can help improve its social impact. Complete transparency and rigorous reporting may reduce fraudulent practices to a great extent. Framing of regulations that aim to protect investors without impeding the gro

wth potential of prospective borrowers and the need of capital formation would lead to overall economic growth and employment generation. An extensive data analysis needs to be done to understand the social, environmental and economic impact of Crowdfunding. Improving financial literacy, partnerships with entrepreneurial hubs and incubators and a strong support from the social media can further accelerate growth in this arena.

wth potential of prospective borrowers and the need of capital formation would lead to overall economic growth and employment generation. An extensive data analysis needs to be done to understand the social, environmental and economic impact of Crowdfunding. Improving financial literacy, partnerships with entrepreneurial hubs and incubators and a strong support from the social media can further accelerate growth in this arena.

References

· Amara Myriam, Amal Ben Cheikh, Tarek Abdellatif, 2015, Crowdfunding: Determinants and motivations of the contributors to the Crowdfunding platforms (https://www.researchgate.net/publication/274064630 )

· Crowdfunding, 2017, Financial Solutions for Sustainable Development, UNDP (http://www.sdfinance.undp.org/content/sdfinance/en/home/solutions/template-fiche12.html )

· “Crowdfunding from an investor perspective”, 2015, Financial Services User Group position paper.

· Eleanor Kirby and Shane Worner, 2014, Crowd-funding: An Infant Industry Growing Fast, Staff Working Paper of the IOSCO Research Department

· Master Direction DNBR (PD) 090/ 03.10.124/2017-1 8 , RBI/DNBR/2017-1 8/57 (https://rbidocs.rbi.org.in/rdocs/notification/PDFs/MDP2PB9A1F7F3BDAC463EAF1EEE48A43F2F6C.PDF)

· SEBI, 2014, Consultation paper on Crowdfunding in India

· Yusimi Rodriguez-Ricardo, María Sicilia, Manuela López, (2018) “What drives crowdfunding participation? The influence of personal and social traits”, Spanish Journal of Marketing – ESIC, Vol. 22 Issue: 2, pp.163-182, https://doi.org/10.1108/SJME-03-2018-004

Disclaimer: The views, opinions and content on this blog are solely those of the authors. ISME does not take responsibility of content which are plagiarized or not quoted